Hurricane Ian will have an industry-changing impact on the future of real estate industry, infrastructure

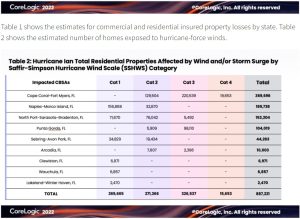

IRVINE, Calif., September 29, 2022—CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today announced residential and commercial wind and storm surge loss estimates for Hurricane Ian. According to this new data analysis, wind losses for residential and commercial properties in Florida are expected to be between $22 billion and $32 billion. Insured storm surge losses in Florida are expected to be an additional $6 billion to $15 billion.

“This is the costliest Florida storm since Hurricane Andrew made landfall in 1992 and a record number of homes and properties were lost due to Hurricane Ian’s intense and destructive characteristics,” said Tom Larsen, Associate Vice President, Hazard & Risk Management, CoreLogic. “Hurricane Ian will forever change the real estate industry and city infrastructure. Insurers will go into bankruptcy, homeowners will be forced into delinquency and insurance will become less accessible in regions like Florida.”

The Implications of Hurricane Ian Recovery

With inflation at a 40-year high, interest rates nearing 7%, and labor as well as materials still in high in demand, CoreLogic anticipates recovery will be slow and difficult. Though recent legislation like the Inflation Reduction Act aims to improve infrastructure and resilience, the real estate industry is poised to evolve. “We’re at a crossroads with Hurricane Ian in terms of adapting to today’s catastrophe risk environment,” said Larsen. “Infrastructure and building codes will evolve so that we can be more resilient ahead of what are bound to be more history-making storms in the near future. We cannot just rebuild; we need to restore for resilience.”

Florida’s real estate market was healthier than average prior to Hurricane Ian, according to CoreLogic economists. “In the second quarter of 2022, Florida posted one of the highest home equity gains in the U.S., with an average of $100,000 in equity per homeowner,” said Selma Hepp, interim lead of the Office of the Chief Economist, CoreLogic. “Florida also had the highest home price gains in July. Gains in equity and record declines in loan-to-value ratios will provide many Florida homeowners with a financial buffer in case economic conditions worsen, as is typically the case following natural catastrophes.”

Source: CoreLogic